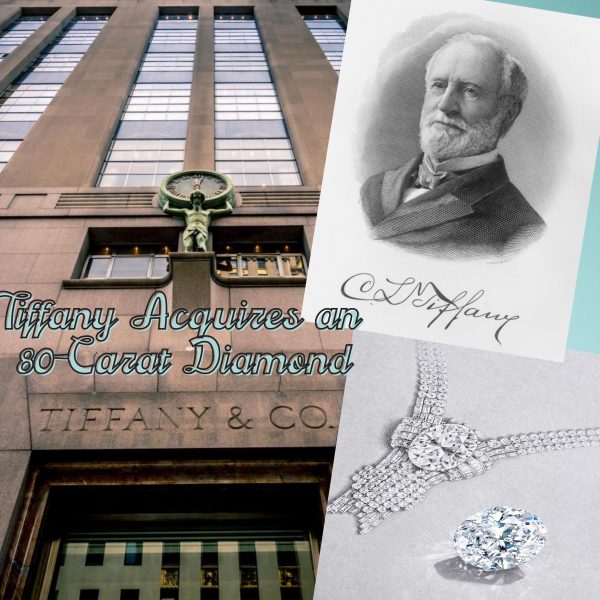

Breaking news for all gem lovers. Tiffany & Co. acquires an exceptional 80-carat diamond to reimagine its historic 1939 World’s Fair Necklace. Expected to be its most expensive piece ever, Tiffany will unveil the diamond necklace in 2022 when the doors of its transformed Fifth Avenue flagship store reopen, making history once again, just as the original necklace did nearly a century ago when it debuted at the World’s Fair in Queens, New York.

In August 2020, OMA unveiled images of the newly transformed Tiffany Fifth Avenue Flagship Store to open in 2022.

In August 2020, OMA unveiled images of the newly transformed Tiffany Fifth Avenue Flagship Store to open in 2022.

The original aquamarine design has been modernized with an extraordinary oval diamond of over 80 carats, the largest diamond ever offered by Tiffany and eclipsed only by the Tiffany Diamond, which famously is not for sale.

«What better way to mark the opening of our transformed Tiffany flagship store in 2022 than to reimagine this incredible necklace from the 1939 World’s Fair, one of our most celebrated pieces when we opened our doors on 57th Street and Fifth Avenue for the first time,» said Victoria Reynolds, Tiffany & Co. Chief Gemologist. «The new necklace perfectly reflects our brand heritage as a New York luxury jeweler, whose founder was known as the ‘King of Diamonds‘.»

Tiffany & Co. 80-carat, D color, internally flawless diamond inspired by necklace from the 1939 World’s Fair.

Tiffany & Co. 80-carat, D color, internally flawless diamond inspired by necklace from the 1939 World’s Fair.

The breathtaking center stone – an over-80-carat, D color, internally flawless oval diamond – is not only very rare, it is a symbol of Tiffany’s industry-first approach to diamond traceability. Responsibly sourced in Botswana, Africa, the diamond will be set by Tiffany artisans in NYC.

Photograph of the aquamarine and diamond necklace from the 1939 World’s Fair_Tiffany & Co. Archives.

Photograph of the aquamarine and diamond necklace from the 1939 World’s Fair_Tiffany & Co. Archives.

The original necklace’s sizable aquamarine and exceptional diamond forms entranced the millions who came to admire the international spectacle. With its forward-looking theme, «Dawn of a New Day,» the 1939 World’s Fair promised a glimpse into «the World of Tomorrow.» The fair’s intention was to inspire, in its over 44 million visitors, the dream of a better and more effervescent tomorrow. Tiffany’s masterpiece did just that – setting the stage for the opening of its iconic flagship store on 57th Street and Fifth Avenue the following year, in 1940 – foreshadowing what will be a similarly historic moment for the brand in 2022.

In 1878, the company purchased the famous Tiffany Diamond, an immense canary yellow stone from the new South African deposits. Once cut, the diamond weighed 128.54 carats.

In 1878, the company purchased the famous Tiffany Diamond, an immense canary yellow stone from the new South African deposits. Once cut, the diamond weighed 128.54 carats.

Tiffany has acquired many rare and remarkable gemstones for its jewelry designs in its 183-year history, including the legendary Tiffany Diamond, one of the world’s largest and finest fancy yellow diamonds, as well as the Hooker Emerald, now exhibited at the Smithsonian and the Mazarin Diamonds, purchased by Tiffany at the auction of the French Crown Jewels.

LoL, Sandra

The massive 75.47-carat Hooker Emerald had been auctioned to Tiffany & Co, which initially set it in a tiara. Despite its beauty, the tiara remained unsold for decades. In 1950, the emerald was re-set into a brooch that included matching earrings. Five years later, the brooch was purchased by Janet Annenberg Hooker. In 1977, she donated it to the Smithsonian.

The massive 75.47-carat Hooker Emerald had been auctioned to Tiffany & Co, which initially set it in a tiara. Despite its beauty, the tiara remained unsold for decades. In 1950, the emerald was re-set into a brooch that included matching earrings. Five years later, the brooch was purchased by Janet Annenberg Hooker. In 1977, she donated it to the Smithsonian.

Photos: © Tiffany & Co. and © OMA